Our Firm

OUR ETHOS

Milton Friedman, 1981. Hoover Institution on War, Revolution and Peace Records, Hoover Institution Archives

The Hollow Success

We are witnessing a paradox at the heart of the modern corporation. Organizations have never been more optimized, yet they have never been more fragile. In our drive to strip away "inefficiency," we have stripped away the very buffers i.e. redundancy, culture, and trust, that allow organizations to survive shocks.

We see leaders achieving what the market defines as success, only to find themselves presiding over hollowed-out institutions. The narratives of "mission" and "purpose" broadcast externally are increasingly disconnected from the human operational reality. We are optimizing a system that produces financial density but human vacuity.

We are winning the game, but the game has ceased to be worth playing.

The Confusion of Means and Ends

This disorientation is not an accident of fate but a direct consequence of a specific historical rupture.

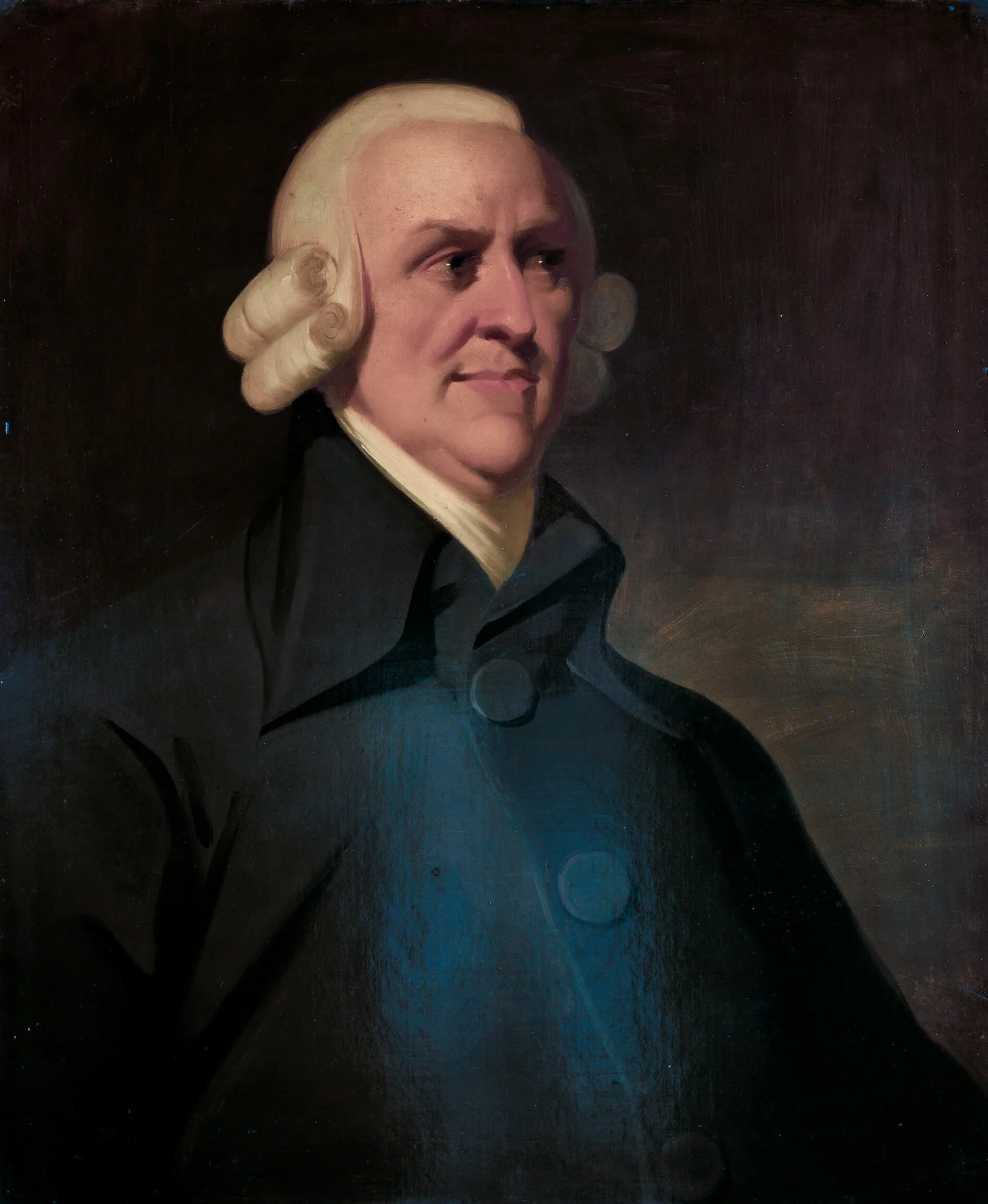

In 1970, the business world adopted a new compass, formalized by Milton Friedman: the idea that the sole social responsibility of business is to increase its profits. In doing so, we unmoored capitalism from its founding philosophy. The widespread implementation of the Friedman doctrine triggered a fatal inversion of logic. Two centuries prior, Adam Smith, the father of modern economics, warned against this precise error. Before his "invisible hand," Smith wrote of the "impartial spectator", the moral conscience that must guide human action. To Smith, the market was a mechanism for social cooperation, not a vacuum of moral indifference. In his classical view, profit was understood as a vital Means to sustain Human Ends. The Friedman shift elevated the Means to the status of the End. It turned the tool into the goal.

The consequences of this inversion are now systemic. By making the financial metric the ultimate compass, we detached economic logic from anthropological reality. We created a closed loop where companies are forced to liquidate their human and cultural capital, the very source of their longevity, to satisfy the short-term demands of the gauge.

We mistook the scoreboard for the sport.

This error has trapped decision-makers in a tunnel of rationality where the only "logical" choice is often the one that destroys the most value over the long term.

The Principled Alternative

Glenshore was founded on a singular premise: The Friedman era is not the eternal rule, but an abnormality in human history.

We advise principled business leaders who recognize that the compass is broken. They are ready to reorient their organizations toward the True North of capitalism: a hierarchy where profit is the means, and Meaning is the end.

We define Meaning not as a vague sentiment, but as an anthropological imperative. It is the ability of a system to satisfy three fundamental human needs:

Agency (the meaningful capacity to act upon the world)

Reciprocity (the maintenance of trust through mutual exchange)

Lineage (the transmission of value to future generations)

We support leaders as they make strategic and financial decisions where capital serves the mission, not the reverse. As business leaders ourselves, our ambition is to champion this alignment alongside our clients, and in doing so, inspire others.

Together, we ensure that decisions made today are defensible not just to shareholders next quarter, but to our successors in the next generation.

The Return of Agency

Moving on from Friedman requires a deliberate act of will by those who hold the levers of the economy.

We envision a business world where the inversion of profit and meaning is corrected. A world where Mergers & Acquisitions are no longer a liquidation of mission, but a transmission of responsibility. A world where the corporation is once again viewed as a human adventure, encoded with a purpose that transcends an Excel spreadsheet.

This is not a retreat from capitalism. It is a restoration of the moral legitimacy Adam Smith originally envisioned. It is the return of a business leader who is sovereign. One who refuses to be a mere functionary of a blind system and chooses instead to be an architect of a human future.

The realignment begins with a choice every business leader can make today: to restore the compass to its True North when making corporate decisions.

Decision after decision. Every single time.

We hope you will join us in making that choice.